Very Basic Financial Statement Stuff

According to the internet . . . Oprah Winfrey once suggested that Serena Williams “sign every check” herself — the interpretation being that business owners should understand and control their finances.

That’s actually very good advice. To do that, entrepreneurs need to have a basic understanding of financial statements.

And, despite what you might think, this isn’t very difficult or complex.

Financial statements are important because they can provide a complete picture of the financial health and status of a company – past present and future.

Let’s look at an illustration of this concept. We’ll imagine a company called Smith’s PB&J – we own it, and we sell peanut butter and jelly sandwiches.

THE PAST: PROFIT AND LOSS (P&L)

To start out, we bought enough bread, peanut butter and jelly to make 2,000 sandwiches. All that stuff cost $500, meaning each sandwich will cost us 25c to make ($500 / 2,000). We decide to sell our sandwiches for $1 each.

In the first month, we sold 1,000 sandwiches! So, our sales were:

$1 x 1,000 = $1,000

That’s $1000 in sales!

And, since we had to make 1,000 sandwiches, it costs us:

25c X 1,000 = $250

to make and sell those sandwiches.

So, how much have we earned?

Sales $1,000

less cost of sales $ 250

equals $ 750

That’s great! We’ve made $750 (our “gross profit”).

But, we’ve had other expenses, too. We had to pay rent, utilities, phone and other monthly expenses. Let’s say those added up to $600.

We’ve really made:

$750 – $600 = $150

This $150 is called “net profit”.

Congratulations! We have a profit and loss statement – also known as a P&L. It looks like this:

Sales $1,000

minus Cost of sales $ 250

equals Gross profit $ 750

minus Expenses $ 600

equals Net profit $ 150

The P&L tells us about the past. In this case, it explains how we did last month.

But, this doesn’t tell the whole story, does it? What about the present? How do things look today, financially speaking?

To understand this, we need a balance sheet.

THE PRESENT: BALANCE SHEETS

Let’s say that we have a balance of $400 in the bank.

And, we have inventory, because we only used some (not all) of the stuff to make the sandwiches. When you figure it out, we have $250 left over in inventory.

In addition, let’s say that we let 50 of those 1,000 customers bought their sandwiches on credit. They agreed to pay for them next week. So, they owe we a total of

$1 per sandwich x 50 = $ 50

This means we have $50 in “accounts receivable”.

We have cash, inventory and accounts receivable . . . these all have value. They are called “assets”.

But, let’s say we also owe some money.

Let’s say we bought all that inventory ($500 worth at the beginning) on credit and we haven’t paid for it yet. This is called “accounts payable”. It is known as a “liability”.

Hey – we own stuff worth $700 (assets) and we only owe $500 {liabilities) – than means our net worth is:

$700 – $500 = $200 (assets minus liabilities)

Congratulations! We’ve just created a balance sheet! It looks like this:

Assets

Cash $ 400

Inventory $ 250

Accounts receivable $ 50

Total assets $ 700

Liabilities

Accounts payable $ 500

Total liabilities $ 500

Net worth $ 200

Total liabilities and net worth $ 700

And, it’s called a balance sheet because, when it’s done correctly, the total assets will always equal the total liabilities and net worth. The two figures will always balance (in this case, $700).

THE FUTURE:

CASH FLOW FORECASTS

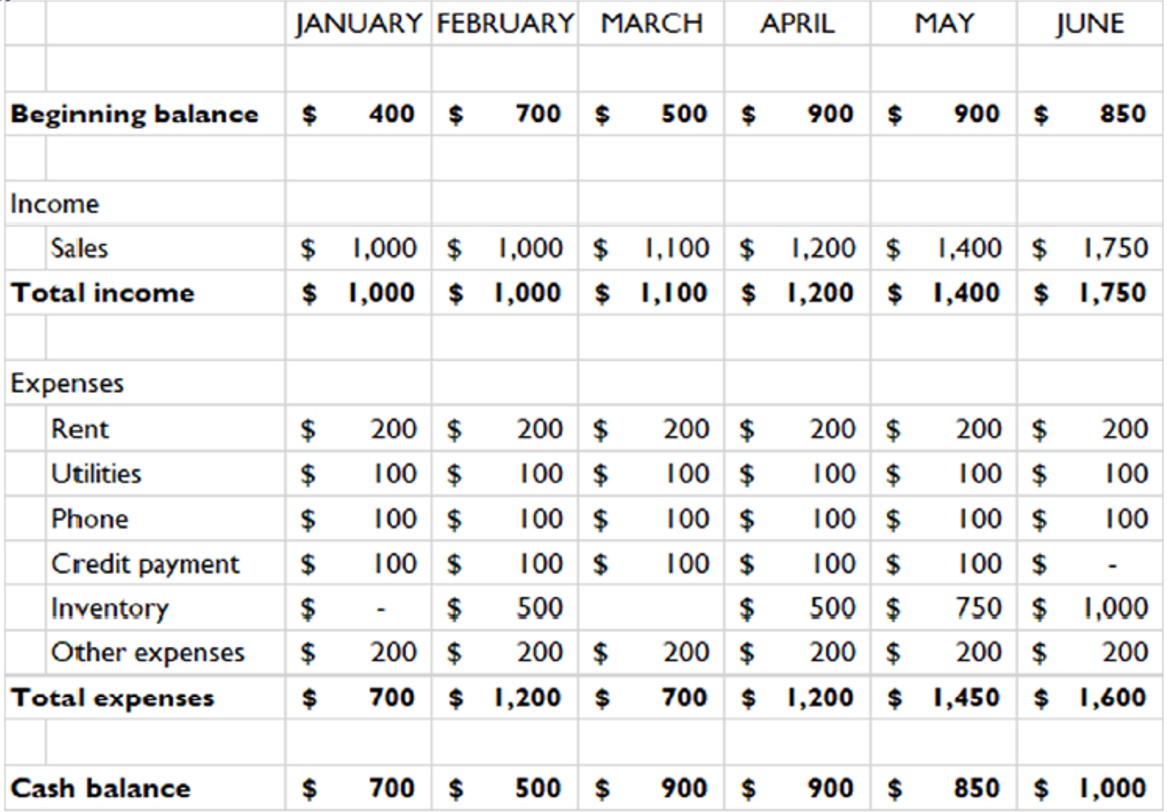

There’s one more piece to this financial puzzle. We need to understand how to plan for future income and future expenses. So, we put together a spreadsheet. We start with our cash balance ($400) and we list, each month, how much we expect to receive and how much we expect to spend.

As you can see by this sample spreadsheet, we start with the beginning balance (the $400 in the bank), we expect to get $1,000 cash in next month, and we expect to spend a total of $700. So, at the end of the month, our cash balance will be $400 + $1,000 – $700 = $700. This number becomes the beginning balance for the next month, and we put in the figures we expect for that month as well.

Congratulations! We’ve just created a cash flow forecast!

This is a valuable tool for cash management. We can see the projected balances at the end of each month and plan accordingly. Maybe we’ll buy more inventory one month to support expected future sales. Or maybe we’ll buy less because we don’t want the bread to spoil. Whatever we do, the spreadsheet will let us know how payment decisions affect our cash balance each month. It’s an incredibly effective financial management tool.

These reports can help us see the past, understand the present and plan for the future. That’s why it’s important for every business owner to have some understanding of financial statements.

Need more help? Want to understand more about this and how you can use it to manage your business? Contact your local SBDC for no-cost consulting services.